(508) 481-2211

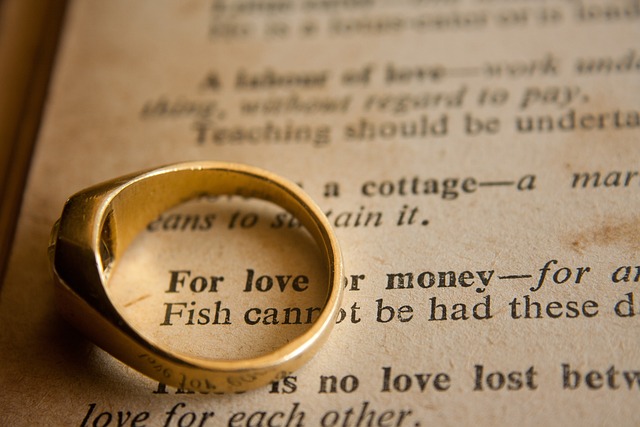

If you are one of the many Americans who are in a second marriage, you may need to revisit your estate strategy.1

Unlike a typical first marriage, second marriages often require special consideration in order to address children from a prior marriage and the disposition of assets accumulated prior to the second marriage.

Second Marriages

Here are some ideas you may want to think about when updating your estate strategy:

- You may want to ensure that your children from your first marriage are set up to receive assets from your estate, even as you provide your second spouse with adequate resources to live should you die first.

- Consider titling of assets. Assets that are jointly owned in your name and your second spouse’s name are set up to pass to your second spouse, often regardless of any instructions in your will.

- If you are designating your second spouse as beneficiary on retirement accounts, remember that once you die, the surviving spouse can name any beneficiary of their choice, despite any promises to name your children from a previous marriage as successor beneficiaries.

- Consider any prenuptial and postnuptial agreements with a professional who has legal expertise in the area of estate management.

- If your new spouse is closer in age to your children than to you, your children may worry that they may never receive an inheritance. Consider passing them assets upon your death. This may be accomplished through the purchase of life insurance.2

- Consider approaches to help protect against the drain that extended care may have on assets designed to support your spouse or pass to your children.

- The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

2. Several factors will affect the cost and availability of life insurance, including age, health and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.